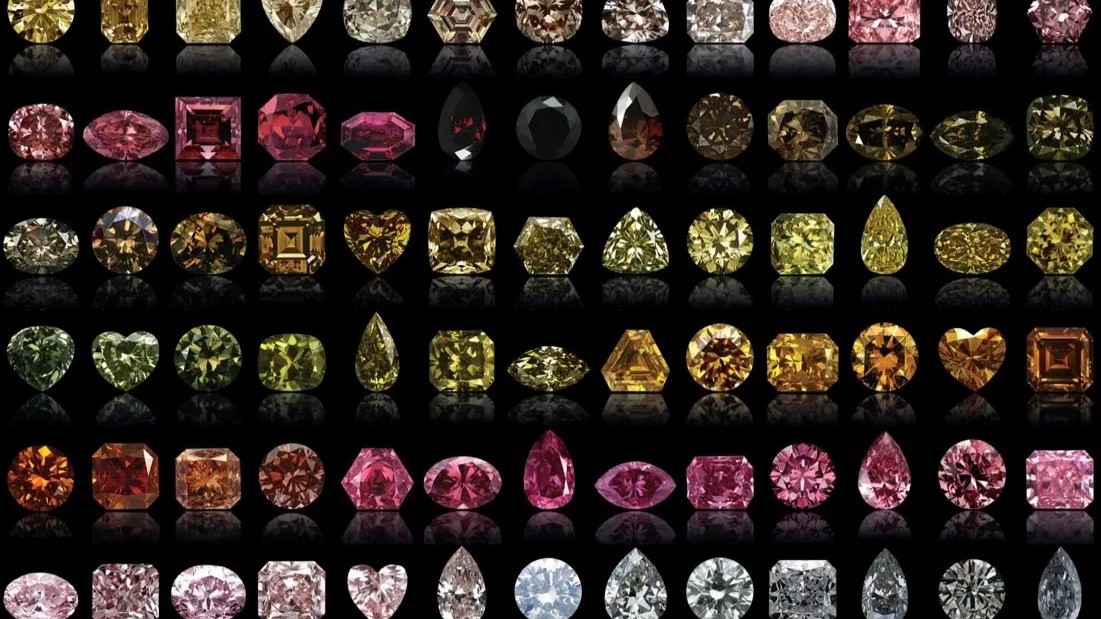

Fancy Color Diamonds in 2025: A Comprehensive Market Analysis of Stability, Rarity, and Long-Term Investment Value

Home

News And Media Fancy Color Diamonds in 2025: A Comprehensive Market Analysis of Stability, Rarity, and Long-Term Investment Value SHOP NOW

0 Comments

Please login to leave a reply.